|

| Why is Tesla stock dropping |

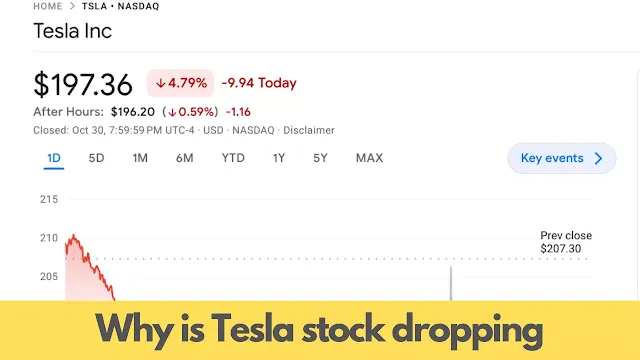

Tesla, the renowned electric vehicle (EV) manufacturer, has been in the spotlight for more than just its innovative electric cars. Recent developments have caused Tesla's stock to decline by around 5%, closing at $197.36 on a particular Monday. The main catalyst behind this drop is the concerning updates from Panasonic, a long-term collaborator and battery supplier to the electric vehicle (EV) manufacturer, which had scaled down its battery cell production in Japan by the end of September 2023. These developments raised worries among investors about a decrease in demand for EVs, particularly for more expensive models that might not be eligible for government tax incentives in the U.S. and elsewhere. It's worth noting that Panasonic cells have been employed in Tesla's older, pricier vehicles like the Model X SUVs and Model S sedans.

Softening Demand for EVs

One of the primary reasons for Tesla's stock decline is the softening demand for electric vehicles. Despite being the world's leading EV manufacturer, signs of slowing demand have emerged, both in the U.S. and globally. Several factors have contributed to this, including rising interest rates, inflation, and the ongoing conflict in Ukraine.

High Valuation

Tesla's stock has been trading at a very high valuation for an extended period. This implies that there is a substantial amount of risk associated with the stock. Any negative news or market shifts can trigger a sharp sell-off, causing the stock to decline.

Production Delays

Tesla has been grappling with production delays, particularly concerning its new Cybertruck and Semi vehicles. These delays have raised concerns about the company's ability to meet the growing demand for its products. Production challenges can significantly impact investor confidence.

Broader Market Sell-Off

The broader market sell-off, which has been occurring in recent months, has also affected Tesla's stock. Investors have been increasingly risk-averse, leading to the selling of stocks in growth sectors, including technology, where Tesla belongs. This overall market sentiment has put downward pressure on Tesla's stock price.

Conclusion

As of October 31, 2023, Tesla's stock has plummeted by over 50% from its peak in November 2021. It remains uncertain when the stock will hit its bottom, and analysts hold divided opinions on its future prospects. The decline can be attributed to a combination of factors, including waning EV demand, Tesla's high valuation, production setbacks, and the broader market's risk aversion.

Investors and stakeholders are closely monitoring the situation, hoping for a reversal in Tesla's fortunes. However, it's essential to keep in mind that the stock market is influenced by a multitude of factors, and Tesla's recovery may depend on various economic and industry developments in the coming months.